Mileage Expense Rate 2025. Mileage reimbursement rates reimbursement rates for the use of your own vehicle while on. 14, 2025 — the internal revenue service today issued the 2025 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes.

For the 2025 tax years (taxes filed in 2025), the irs standard mileage rates are: But, as this guide will show, there’s a.

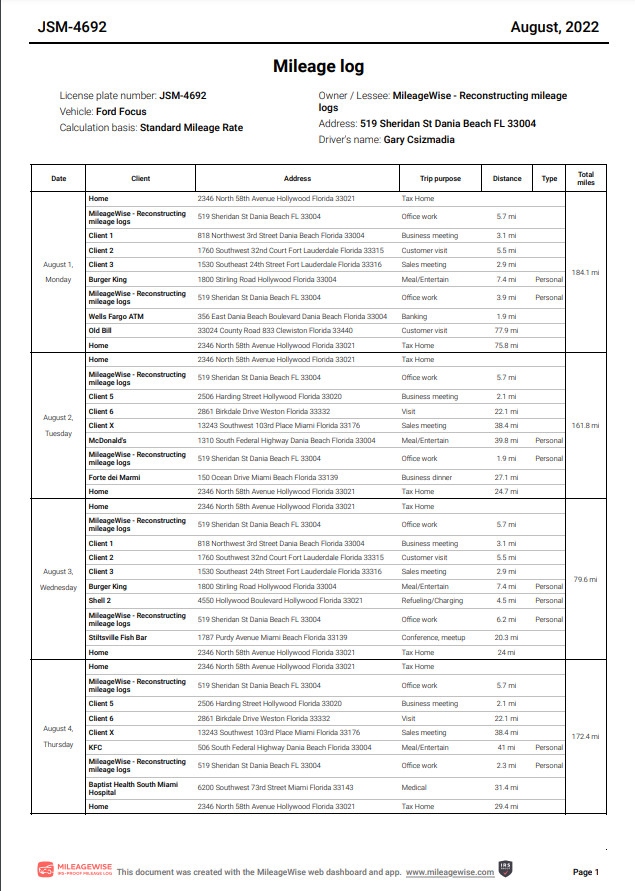

Free Mileage Log Templates Smartsheet (2025), A guide to uk business mileage allowance. 64¢ per kilometre driven after that;

2025 CRA Mileage Rate Explained How to Claim CRA Deductions, The irs issues standard mileage rates for 2025. Whether you’re an employer or an employee, it’s easy to get confused when it comes to claiming car mileage.

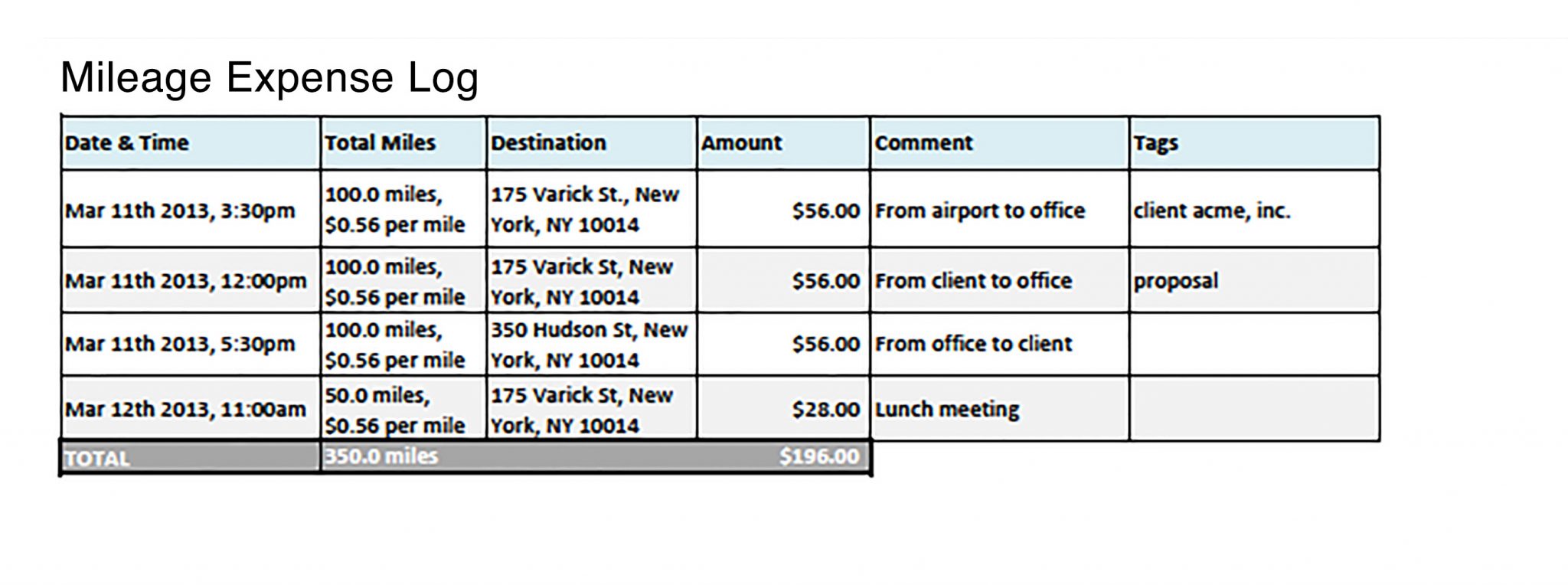

IRS Compliant Mileage Expense Log > Falcon Expenses Blog, For tax year 2025, the most recent year for which complete figures are available, the total value of the home office business deductions was just over. You can use this mileage reimbursement.

Standard Mileage vs. Actual Expenses Getting the Biggest Tax Deduction, This rate is applicable for. But, as this guide will show, there’s a.

Mileage Allowance Free Printable Mileage Log 2025 Form Printable, For the 2025 tax years (taxes filed in 2025), the irs standard mileage rates are: The current mileage rates are:

CPM Cost Per Mile How much to maintain my truck? Donahue Truck, 70¢ per kilometre for the first 5,000 kilometres driven; For tax year 2025 (the taxes you file in 2025), the irs standard mileage rate is 65.5 cents per mile when used for business.

Mileage Log Samples Standard Mileage Rate and Actual Expense Method, Whether you’re an employer or an employee, it’s easy to get confused when it comes to claiming car mileage. You can use this mileage reimbursement.

Mileage Reimbursement Form in PDF (Basic) / Mileage Reimbursement Form, The current mileage rates are: Calculating your business expenses accurately is vital for complying with tax.

Standard Mileage vs Actual Vehicle Expenses for Uber Drivers, For tax year 2025, the most recent year for which complete figures are available, the total value of the home office business deductions was just over. The medical and moving mileage.

ReadyToUse Yearly Mileage Log Template MSOfficeGeek, Mileage rate increased to 67 cents a mile (up 1.5 cents from 2025). For tax year 2025, the most recent year for which complete figures are available, the total value of the home office business deductions was just over.