Standard Deduction 2025 Married Filing Jointly 2025. The tax brackets, standard deduction, and the capital gains tax cutoff point for single and married filing jointly filing statuses will go up in 2025. The 2025 standard deduction amounts are as follows:

For the tax year 2025, the top. For the 2025 tax year (for forms you file in 2025), the standard deduction is $13,850 for single filers and married couples filing separately, $27,700 for married.

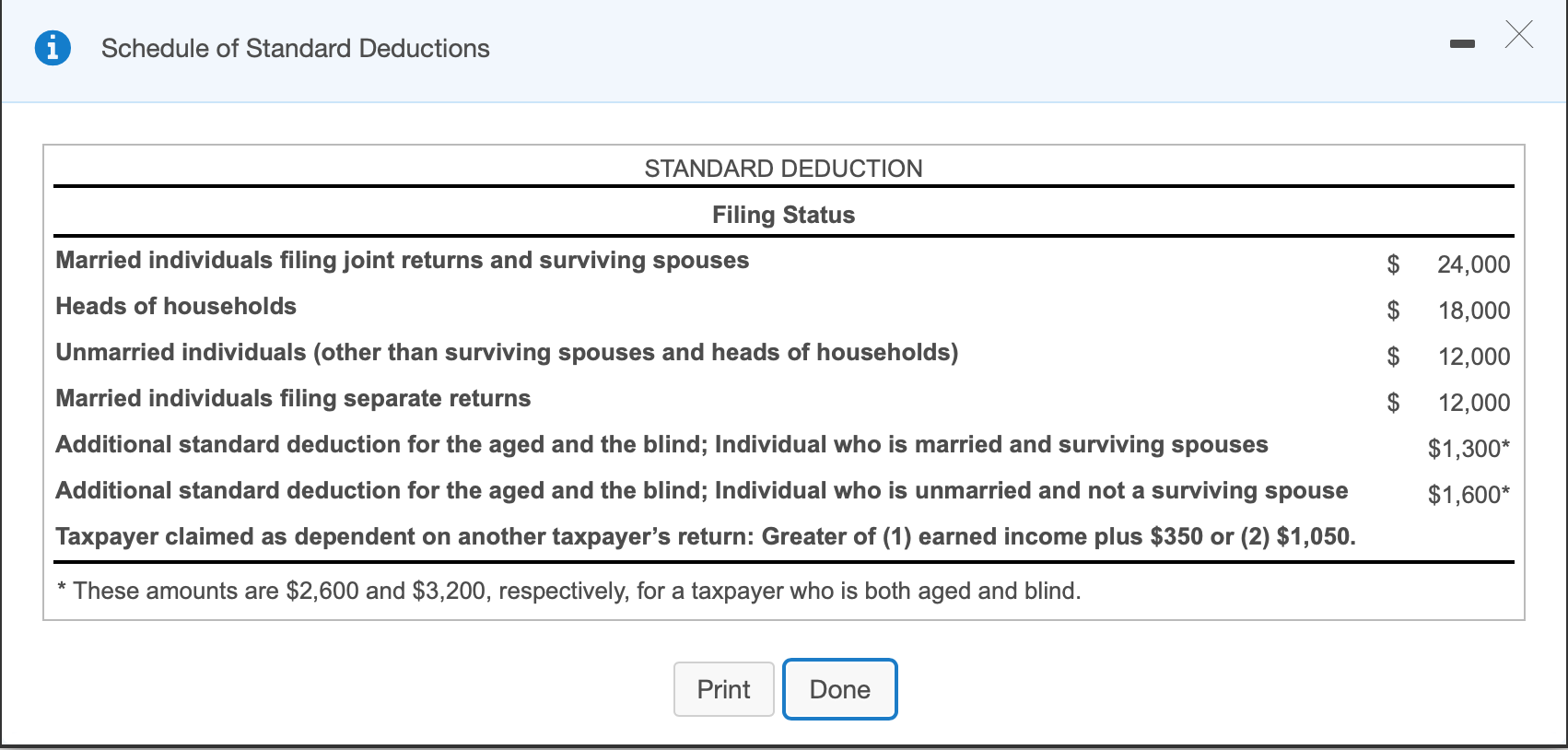

The standard deduction will increase by $750 for single filers and by $1,500 for joint filers (table 2).

2025 Tax Brackets Married Filing Separately 2025 Dalila Magdalene, If you’re at least 65 years old or blind at the end of 2025, the additional standard deduction for the 2025 tax year is: The 5.4% increase translates to a $750 jump in the basic standard deduction from 2025 to 2025.

Tax Brackets 2025 Usa Married Filing Jointly Reyna Clemmie, The 2025 standard deduction amounts are as follows: For 2025, that extra standard deduction is $1,950 if you are single or file as head of.

Tax Brackets 2025 Married Jointly Irs Deeyn Evelina, For 2025, that extra standard deduction is $1,950 if you are single or file as head of. Married couples filing jointly will see a deduction of $29,200, a boost of $1,500 from 2025, while heads of household will see a jump to $21,900 for heads of.

Tax Brackets 2025 Married Jointly Over 65 Elyse Imogene, For the tax year 2025, married couples filing jointly (those who are legally married and choose to file their taxes together) are eligible for a standard deduction of. For the 2025 tax year, the standard deduction will increase by $750 for single filers and those married filing separately, $1,500 for married filing jointly, and $1,100 for.

2025 Tax Brackets Announced What’s Different?, What are the changes to the alternative minimum tax (amt) for tax year. A married couple filing their 2025 tax return jointly with an adjusted gross income of $125,000 is entitled to a standard deduction of.

2025 Federal Standard Deduction For Married Filing Jointly Merla Stephie, For the tax year 2025, the standard deduction for married couples filing jointly will increase to $29,200, an increase of $1,500 over the tax year 2025. The standard deduction for married couples filing jointly for tax year 2025 will rise to $29,200, an increase of $1,500 from tax year 2025.

Tax Table 2025 Married Filing Jointly Laura, Single or married filing separately: The standard deduction for married couples filing jointly for tax year 2025 will go up by $1,500 to $29,000.

2025 Tax Brackets Standard Deduction Desiri Beitris, For the tax year 2025, the top. In 2025, it is $14,600 for single taxpayers and $29,200 for married taxpayers filing jointly, slightly increased from 2025 ($13,850 and $27,700).

Standard Deduction Mfj 2025 Dode Nadean, Ira contribution limits for 2025 [save more in 2025] wealthup tip: The 2025 standard deduction amounts are as follows:

Tax Year 2025 Standard Deduction For Seniors Rhody Cherilyn, The standard deduction will increase by $750 for single filers and by $1,500 for joint filers (table 2). If you’re at least 65 years old or blind at the end of 2025, the additional standard deduction for the 2025 tax year is:

The standard deduction for couples filing jointly is $29,200 in 2025, up from $27,700 in the 2025 tax year.